Forfaiting & Loan Trading

Midfinance Bank Forfaiting and Loan Trading Activities

Midfinance Bank has started its Global Forfaiting and Loan Trading business in 1997 and is today one of the major players in this area. As an indication of our early commitment to this niche field of banking, we were one of the first to join the International Forfaiting Association, which later renamed to International Trade and Forfaiting Association (https://itfa.org/). In addition, Midfinance Bank N.V. is a member of Loan Market Association (LMA) - (https://www.lma.eu.com)

Global Forfaiting and Loan Trading department trades in a wide range of instruments, such as syndicated loans, promissory notes, bills of exchange, letters of credit, Islamic finance agreements and silent-risk confirmations as well as corporate loans.

Please note that we are always eager to add new countries to our portfolio; therefore, feel free to approach us by email at [email protected] with propositions for new countries in which we could service you in some way.

Loan Trading

Midfinance Bank N.V. is one of the most active players in the hard currency LMA structured loans to the financial institutions sector. The bank enters the deals either by primary participation as an original lender or purchase via secondary market from other banks.

What is Forfaiting?

Forfaiting is a method of trade finance whereby Midfinance Bank NV purchases, on a without recourse basis debt obligations arising from the supply of goods and/or services.

In a forfaiting transaction, the exporter agrees to assign its rights to claim for payment of goods or services delivered to an importer under a contract of sale, in return for a cash payment from Midfinance Bank.

In exchange for the payment, Midfinance Bank takes over the exporter's debt instruments and assumes the full risk of payment by the importer. The exporter is thereby freed from any financial risk in the transaction and is liable only for the quality and reliability of the goods and/or services provided.

Forfaiting is a tailor-made financing solution designed according to the needs of the exporter:

- 100% financing of the goods without recourse to the importer.

- The debt is usually evidenced by Bills of Exchange, Promissory Notes or a Letter of Credit , Stand by L/C

- Payment is guaranteed by a local bank in the form of aval, or bank guarantee or l/c confirmation etc.

- Amounts financed can range from US$100,000 to US$100 million or more

- Interest rates can be agreed on a fixed rate, although it can also be arranged on a floating interest-rate bearing basis.

- Fast conclusion of transactions

- Tailor-made financing solutions;

- Simple documentation requirement;

- Relieves the exporter from administration and collection problems.

The advantages of forfaiting for the exporter:

- Since the transactions are without recourse; fully eliminating political, transfer and commercial risk of the importer,

- Protects the exporter from future interest rate increases or exchange rate fluctuations

- Gives the ability to the exporter to provide longer payment terms and yet receive the proceeds cash.

- Enables the exporter to do business in countries where the country risk would otherwise be too high.

- The balance sheet of the exporter does not carry accounts receivable, bank loans or contingent liabilities.

- No administrative and legal expenses, that normally accompany other financing arrangements

- Importer receives additional credit through forfaiting from the supplier/exporter

The advantages for the investing bank:

- Maximum use of credit lines; not directly used credit lines can be utilized in the forfaiting market

- Liquid assets; in case of need the credit lines can be freed in a short term

- Attractive Yield; trade related assets have better returns than syndicated loans

- Ease and Simplicity of Documentation; simple and quite uniform documentation which eliminates legal costs each time and makes fast bookings possible

- Flexibility in terms of tenor: Transactions may vary from 6 months to 5 years

Through forfating banks may offer to their customers more possibilities in terms of

- Country risk

- Bank risk

- Amount

- Maturity

How does a Forfaiting Transaction Work?

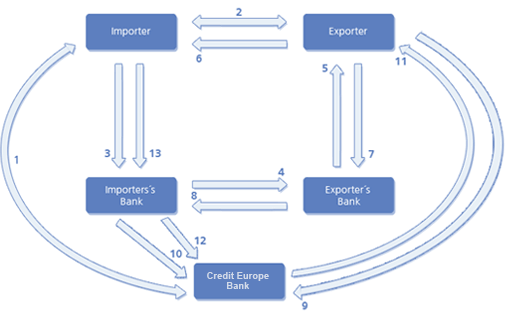

Discount Letters of Credit

- Forfaiting terms are agreed between the exporter and Midfinance Bank

- Commercial contract for the underlying trade is made.

- Importer gives instruction to its bank to issue an l/c

- L/C is issued to the exporter’s bank to be advised and/or confirmed to the importer’s bank

- L/C is advised to the exporter by th exporter’s bank

- The goods are shipped by the exporter.

- Exporter presents shipping documents to its bank for acceptance.

- Exporter’s bank sends documents to importer’s bank

- Exporter assigns its rights to Midfinance Bank

- Importer’s bank accepts the assignment

- Midfinance Bank discount the L/C and pay to the exporter

- At maturity the Importer’s bank pays to Midfinance Bank

- Importer pays to its bank.

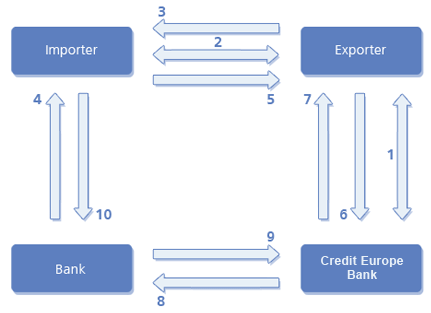

Discount of Receivables

- Forfaiting terms are agreed between the exporter and Midfinance Bank

- Commercial contract for the underlying trade is made.

- The goods are delivered by the exporter.

- Presentation of debt instruments to the guarantor bank for avalisation. Transactions are evidenced by negotiable debt instruments such as P/N’s or B/E’s

- Delivery of avalised debt instruments to the exporter for acceptance.

- Delivery of fully endorsed documents to Midfinance Bank.

- Midfinance Bank pays the exporter the discounted contract value.

- On maturity Midfinance Bank presents the debt instrument to guarantor.

- Guarantor bank pays Midfinance Bank

- Importer pays guarantor.

Calculation Methods

What information do we need to quote pricing?

- 1. Name and Country of the B/E, P/N avalising or L/C issuing/confirming bank

- 2. Currency and amount of the transaction

- 3. Repayment period and structure

- 4. Type of Transaction (goods involved, shipment date planned etc)

- 5. Envisaged date of discounting

What does our prices consist of?

- The Discount Rate:

- Libor: Currency and maturity matching London Inter-Bank Offered Rates

- Spread: Calculated depending on the risk involved, tenor, currency and the amount involved of the transaction

- Days of Grace : Calculated to reimburse Midfinance Bank for any delays anticipated in collecting receivables in the obligor’s country

- Commitment fee : Calculated over the face value of the transaction from the date of the acceptance of a firm offer to discount the transaction until the actual date of discounting.

Discount Calculations

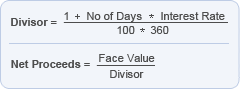

Midfinance Bank uses two main discounting methods

- Straight Discount: Expresses the discount rate as a percentage discounted from the face value given the life of the specific maturity or maturities.

- Discount to Yield: Expresses the discount rate as a true interest cost, on a per annum basis. The Discount to Yield calculation is the yield a present value will achieve as it reaches its future value (face value) at maturity.